too big to fail book summary

Ultimately it is a human drama about the fallibility of people who thought they themselves were too big to fail 7. Feldman examine the too big to fail doctrine and show how policymakers made the financial system riskier by implicitly promising to bail out the biggest banking institutions.

A Brilliantly Written And Gripping Account Of The Events Around The Fall Of Lehman Bros Andrew Ross Sorkin Wall Street Finance Books

A close look behind the scenes between late March and mid-October 2008.

. Andrew Sorkin wrote a book titled Too Big To Fail. Too Big To Fail. This book focus on the collapse of the investment bank Lehman Brothers Merrill Lynch was sold by Bank of American Freddie Mac and Fannie Mae was nationalized and the government took 80 percent of AIG that took place on the weekend of September 15 2012.

Too Big to Fail is a detailed account of the personalities and decisions that led to the 2008 financial crisis and how the economy was propped up. Too Big To Fail. Too Big to Fail is a non-fiction account of the financial crisis that hit the United States in 2008 which resulted in the implementation by the federal government of the Troubled Asset Relief Program or TARP which purchased bad assets and invested public money directly in financial institutions in an effort to stabilize the system.

Andrew Sorkin has compiled a number of insightful primary sources from the major players that allows us to get a glimpse of the backroom warnings arguments and deals in that turbulent time. Millennials on the Margins. The book provides an overview of the financial crisis of 200708 from the beginning of 2008 to the decision to create the Troubled Asset Relief Program TARP.

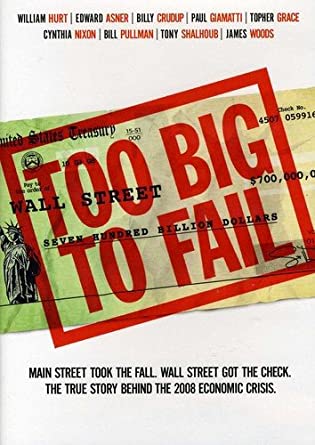

Too Big to Fail Summary by Andrew Ross Sorkin will bring closer to you The Inside Story of How Wall Street and Washington Fought to Save the Financial System--and Themselves. Conversations among Hank Paulson the Secretary of the Treasury Ben Bernanke chair of the Federal Reserve and Tim Geithner. The Inside Story of How Wall Street and Washington Fought to Save the Financial Systemand Themselves written by American journalist Andrew Ross Sorkin is a nonfiction work published in 2009.

Too Big To Fail Prologue-Chapter 1 Summary Analysis Prologue Summary In the Prologue Sorkin introduces readers to the central event of the books narrative explaining that he interviewed more than 200 people connected to the 2007-2008 financial crisis in America. Ad Free shipping on qualified orders. Book Summary Too big to fail is a book written by Andrew Ross Sorkin in the year 2009.

Before she begins her economics degree she will spend the summer as an intern in the Takeovers Acquisitions team at the London branch of global investment bank Kruger Partners. Too Big to Fail was a film that was adapted from the same name book by Andrew Ross Sorkin and it was based on the true story of the 2008 financial crisis that was occurred in USA that was mainly caused by Real estate bubbles. Summary for Too Big to Fail.

Millennials on the Margins. Anita Sands and Madeline Goodman. It is not just another essay on the causes of the crisis even if after reading it feels like something lighter.

To Sorkin this book is a chronicle of failurea failure that brought the world to its knees and raised questions about the very nature of capitalism 7. Read customer reviews find best sellers. The Inside Story of How Wall Street and Washington Fought to Save the Financial Systemand Themselves written by American journalist Andrew Ross Sorkin is a nonfiction work published in 2009.

Too Big to Fail. Stern and Ron J. Andrew Sorkin wrote a book titled Too Big To Fail.

Chronicles the financial meltdown of 2008 and centers on Treasury Secretary Henry Paulson. Boost your life and career with the best book summaries. This book focus on the collapse of the investment bank Lehman Brothers Merrill Lynch was sold by Bank of American Freddie Mac and Fannie Mae was nationalized and the government took 80 percent of AIG that took place on the weekend of September 15 2012.

Too Big to Fail. Get the key points from this book in less than 10 minutes. It is becoming increasingly clear that those who we allow to fail or fall behind are really not so much them as they are us In ways that may not be wholly apparent particularly in times of social upheaval Americans are.

Too Big To Fail. The subtitle accurately describes what the work accomplishes and the book is the product of more than five hundred hours of interviews with more than two hundred. This book focus on the collapse of the investment bank Lehman Brothers Merrill Lynch was sold by Bank of American Freddie Mac and Fannie Mae was nationalized and the government took 80 percent of AIG that took place on the weekend of September 15 2012.

Too Big To Fail Themes Wall Street Versus Main Street As the 2008 financial crisis unfolded the media in particular characterized the activities of the big banks as helping Wall Street at the expense of Main Street which exasperated 32 some of the key players including Richard Fuld. Browse discover thousands of brands. Too Big to Fail is an altogether excellent book by financial journalist Andrew Ross Sorkin.

Executive Summary of Too Big To Fail Andrew Sorkin wrote a book titled Too Big To Fail. Book Summary By Andrew Ross Sorkin 10 min 6312 Audio available Read now Listen now Preview Long before 2008 and the financial crisis hit critical mass there were warnings about the dangers of the risks being taken. Its a compelling narrative that tells the story of how the nations largest and most prestigious financial institutions came to the brink of collapse and almost took the entire economy with them in the great economic crisis of 2008.

In this clearly prophetic book Gary H. Free easy returns on millions of items. The subtitle accurately describes what the work accomplishes and the book is the product of more than five hundred hours of interviews with more than two hundred.

Too Big to Fail. Even as Wall Street attempted to decrease risk by trying new things they only made things worse over time. We follow Richard Fulds benighted attempt to save Lehman Brothers.

Rosannas future is carefully mapped out and she is leaving nothing to chance. The book tells the story from the perspectives of the leaders of the major financial institutions and the main regulatory authorities describing in a very detailed manner their everyday discussions and decisions during that difficult period.

The Ascent Of Money By Niall Ferguson 9780143116172 Penguinrandomhouse Com Books Niall Ferguson World History Penguin Books

Looks Like Cool Book From Anthropologie Happiness Project Book Happiness Project Gretchen Happiness Project

Pin On Books And Everything To Do With Them

Saw The Movie Now I Must Read The Book Water For Elephants Books Elephant Book

A Magical World In School Amari And The Night Brothers Review And Discussion Questions Down The Hobbit Hole Blog Best Quotes From Books Good Books Elementary Novels

Too Big To Fail By Andrew Ross Sorkin Book Andrew Ross Sorkin Fails Andrew

Big Business A Love Letter To An American Anti Hero By Tyler Cowen St Martin S Press Big Business Heroes Book Business Ebook

The Shack Book Review Good Books Book Worth Reading Worth Reading

53 Books That Will Definitely Make You Cry The Book Thief Markus Zusak Books To Read

Film Analysis Too Big To Fail Simtrade Blogsimtrade Blog

Too Big To Fail 2011 Urdu Airlive Media Station Bestselling Books Tony Shalhoub Andrew Ross Sorkin

Movie Review Of Too Big To Fail Fintech Magazine

Too Big Too Fail Book Worth Reading 2008 Economic Crisis William Hurt

Too Big To Fail The Inside Story Of How Wall Street And Washington Fought To Save The Financial System And Themselves Paperback Walmart Com Business Books Andrew Ross Sorkin Books To

5 20 Too Big To Fail Fails Andrew Ross Sorkin Street Fights

Too Big To Fail See Movie Bestselling Books New Movies

A Lie Too Big To Fail The Real History Of The Assassination Of Robert F Kennedy Jfk Jfk Assassination Kennedy